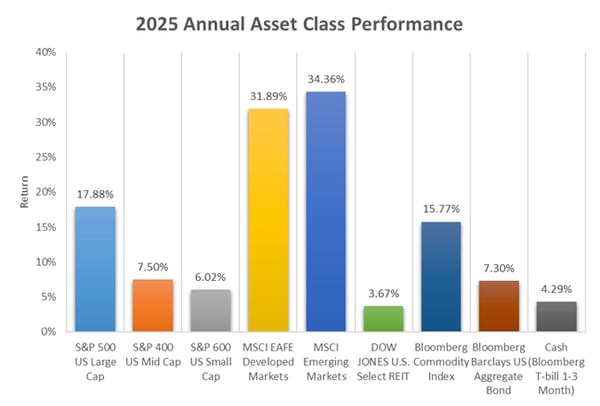

- Markets produced strong returns in 2025 after experiencing a vicious selloff earlier in the year. All nine major asset classes finished the year in positive territory.

- Foreign equities were the top performer, aided by a weakening US dollar. We remain bullish on foreign equities due to reasonable valuations, solid growth, diversification, and an expected continuation of the dollar’s downward trend.

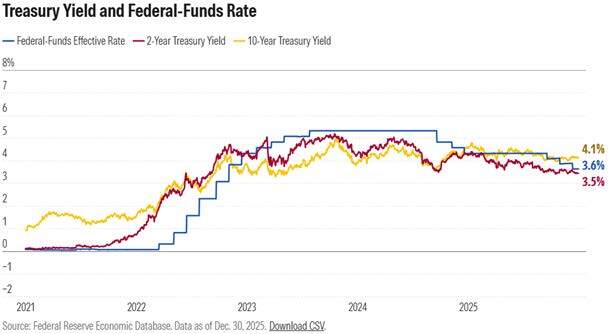

- The Federal Reserve cut rates twice in the fourth quarter and three times in 2025. The longest government shutdown in history caused more dissenters among the ranks than usual and we expect the central bank to pause rate movements while awaiting its new Chairperson.

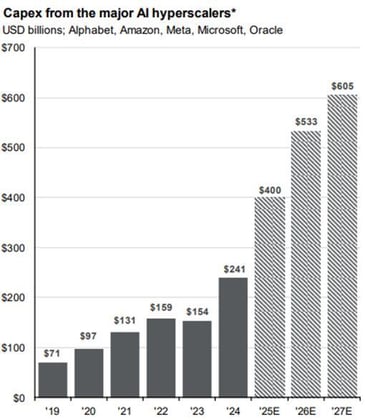

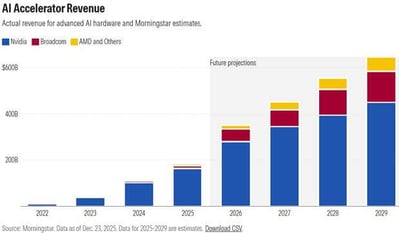

- Artificial intelligence spending has made up a significant portion of total US Gross Domestic Product (GDP). While risks are present, the projected levels of capex and revenue are promising.

Source: YCharts

Market Returns

Markets capped off another strong year of returns with solid yet muted performance in the fourth quarter. Eight of the nine major asset classes finished in the green during the quarter, with Real Estate (REIT) being the lone decliner. We own zero REIT in client portfolios. The S&P 500 rose 2.7% as investors pondered the future payoff of extraordinary artificial intelligence spend.

For the year, all asset classes finished in positive territory as noted in the chart to the left – a remarkable end result after the worst one-week selloff in the past five years during April’s tariff announcements. Market resilience aside, 2025 reminded investors of the importance of diversification and the influence of currency exposures. After a decade of US equity outperformance (sans 2017), international developed and emerging market asset classes took the crown in ’25 with spectacular returns of 31.9% and 34.4% respectively. International developed had its best year since 2009 as foreign economies benefited significantly from a weakening US dollar.

On home soil, the S&P 500 continued climbing a wall of worry and flailing consumer sentiment to finish the year up 17.9% after robust returns of 25.0% in 2024 and 26.3% in 2023. The exceptional three-year run has left US equities trading at elevated valuations but stout earnings momentum continues to support those valuations.

US mid and small caps delivered modest gains in 2025. We feel confident in the future return prospects of mid and small cap given discounted valuations and macro stability. Real estate and commodities offered a mixed bag during the year. Within commodities, precious metals soared while energy fell due to weakness in natural gas.

Bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, returned 7.3% in 2025 and were supported by high starting yields and stable credit spreads.

International Performance and the US Dollar

As mentioned in the previous section, international stocks produced a banner year in 2025. Solid and steady earnings growth, widespread accommodative monetary and fiscal policy, and aggressive government spending in some countries were all contributing factors.

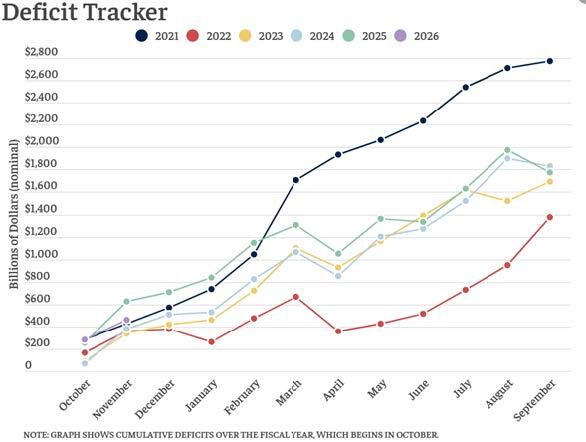

Another substantial contributor to international returns was the slide in the US dollar. The MSCI EAFE International Developed Index was up 31.9% versus a return of just 20.6% in local currencies, signaling the degree of US dollar weakness. The dollar’s 14-year bull run came to an end in 2025. It dropped 12% from peak to trough within the year, marking its sharpest annual decline since 1985. The first six months of 2025 represented the worst first half performance for the dollar since 1973. Foreign central banks and investors rotated away from the dollar due to America’s large and growing fiscal deficits, volatile tariff policies, and path of monetary policy.

Below is a chart of US yearly deficits. In 2025, the country ran a deficit of $1.8 trillion, bringing the national debt to $38 trillion. The federal government spent 19% of all federal revenue collections on interest payments on the national debt. That makes net interest the third largest government expenditure after Social Security and Medicare. The US dollar is not at risk of losing its status as the reserve currency of the world but we believe the dollar might weaken further in 2026. We are maintaining our sizeable allocation to international and emerging market equities in portfolios.

Source: Bipartisan Policy Center

Federal Reserve

The Fed cut interest rates twice in the fourth quarter to a target range of 3.50%-3.75%, down from 4.25%-4.50% at the beginning of 2025. The Federal Open Market Committee (FOMC) is experiencing an uncommonly wide variance of opinions amongst its members. There were three dissenters in the December vote and six “soft dissenters” that made their differing opinions on rates known in other channels.

One reason for the divergence of opinions stemmed from a lack of concrete economic data. It almost feels like old news but the US government experienced its longest shutdown in history in the quarter. The 43-day shutdown impacted near-term economic data visibility and made it harder for FOMC members to coalesce.

Source: Morningstar, Federal Reserve Economic Database

It’s fair to assume no action on rates until President Trump announces the new Fed Chair. Chair Jerome Powell’s term ends in May. The new Chairperson is expected to bring with them a more dovish approach to rates given Trump’s outspoken desire for more cuts. Treasury Secretary Bessent was just on record saying Fed rate cuts are “the only ingredient missing” for even stronger economic growth. We believe rates are above neutral assuming inflation continues its downward glide path and we support a measured, apolitical approach to rate setting.

Examining Artificial Intelligence Growth

US GDP (Gross Domestic Product) grew 4.3% in the third quarter, beating economist expectations of 3.2% and growing at the fastest pace in over two years. AI investment is responsible for a significant portion of that growth. According to JP Morgan, AI-related capital expenditure contributed 1.1% to GDP growth in the first half the year, making up a larger slice of the GDP pie than the ever-mighty US consumer.

There are certain risks to AI-related stocks such as potential deterioration in funding, energy limitations impacting the buildout, that the technology ends up providing less utility than originally thought, or a new greater technology develops. However, we believe the odds of continued growth outweigh downside risks at this time given projected capex from hyperscalers like Alphabet and Microsoft and projected revenue growth from hardware players like Nvidia and Broadcom.

Source: JP Morgan Asset Management

Source: Morningstar

Bonds

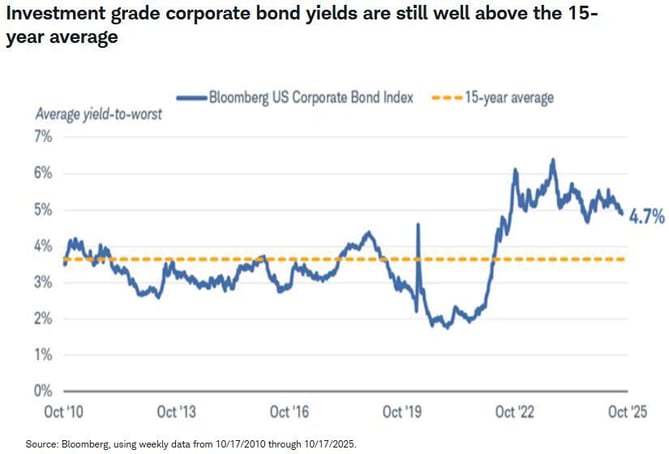

Bonds enjoyed their best year of performance since 2020, with the Bloomberg Agg finishing the year up 7.3%. The asset class benefited from stable and tight spreads, general risk-on sentiment, and three Fed cuts that brought down Treasury yields. Even after 2025’s solid performance, yields remain high and far above 15-year median yields across fixed income sectors.

With attractive carry dynamics and potential for continued price appreciation alongside further rate cuts, the setup in bonds is appealing.

Source: Schwab

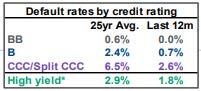

High yield default rates, another indicator of bond market health, are well below 25-year averages across BB, B, and CCC ratings (see chart below). Additionally, Fitch Ratings forecasts downward movements in defaults for high yield and leveraged loans in 2026.

Source: JP Morgan Asset Management

Outlook

2025 represented a broadening out in asset class and sector performance. US value outperformed US growth in the fourth quarter and small caps kept pace with large caps from the April tariff-induced selloff through year end. We enter 2026 positioned for further broadening in markets. The varied performance of international and emerging market equities, US equities, and bonds highlights the importance of asset class diversification and maintaining a consistent approach to portfolio strategy.

We believe markets will continue to deliver solid returns in 2026. Consensus earnings growth expectations are around 13%, monetary policy here and abroad is expected to remain accommodative, and foreign outlooks are improving with China growth and Eurozone fiscal stimulus. Additionally, the US consumer is on solid footing, albeit in a K-shaped pattern, and Americans are in store for tax refunds roughly 50% higher than the 15-year average. Although domestic valuations are elevated, there are no glaring threats to this bull market. However, the environment can change quickly and a pullback would not be surprising.

In mid-December, we rebalanced portfolios to bring equity and fixed income weights back to target. The rebalance led to trimming back winners within equities and adding back to fixed income. Rebalancing is a way to keep portfolio risks aligned with established targets and client risk tolerances, and we thought it was a great time to take some chips off the equity table.

We also introduced many Active ETFs into portfolios during the rebalance. Active ETFs are different from traditional ETFs that track an index in that they are actively managed by a team of investors like a mutual fund. The Active ETF landscape has grown by leaps and bounds over the past few years and had reached a suitable scale for us to allocate. Active ETFs usually have lower expense ratios and are more tax efficient than mutual funds.

Speaking of taxes, we continue to apply and hone a more tax-aware investment philosophy. Whether that shows up in your portfolios as more municipal bonds or an asset location strategy, tax considerations are an additional lens in which we structure portfolios and evaluate investments.

Happy New Year and best wishes for a healthy and prosperous 2026.

Kyle Matthews, CFA on behalf of Miller Financial Services and OnePoint BFG Wealth Partners

DISCLAIMER

Investment advisory and financial planning services offered through Bleakley Financial Group, LLC, an SEC registered investment adviser, doing business as OnePoint BFG Wealth Partners and Miller Financial Services.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Nothing in this material should be construed as investment advice offered by OnePoint BFG Wealth Partners or Miller Financial Services. This market update is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. Neither OnePoint BFG Wealth Partners nor Miller Financial Services guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward-looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.