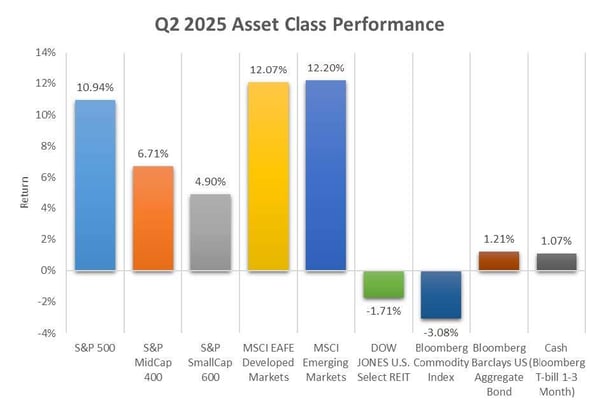

- Markets charged higher this quarter after experiencing a pronounced selloff early in the period. US large-cap, international developed, and emerging market asset classes were all up double-digits.

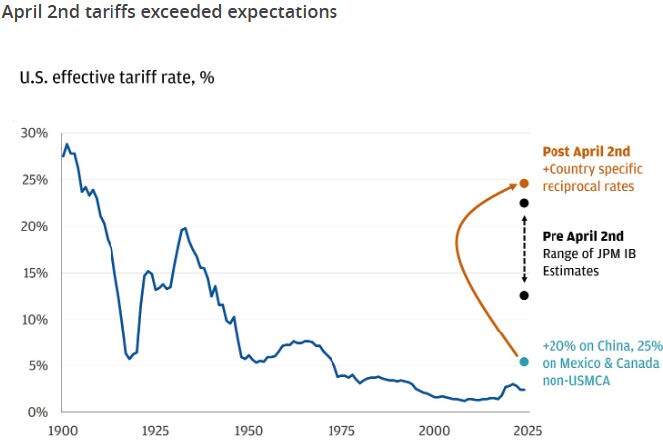

- President Trump sent shockwaves around the globe with surprisingly widespread protectionist tariffs. Markets rebounded quickly after an announced pause for negotiation.

- International equities continued their strong stretch and continue to be boosted by a weakening US dollar, the attractiveness of cheaper relative valuations, and targeted efforts to “de-dollarize”.

- The bond market posted positive returns during the quarter after also experiencing bouts of volatility. Concerns about a rising US fiscal deficit and declining demand for US debt prompted swings in the yield curve.

source: YCharts

Market Returns

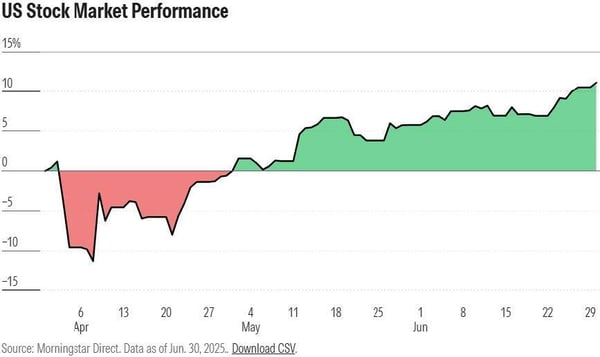

Markets generated significant policy-induced volatility in the second quarter. A precipitous early quarter stock market selloff saw the S&P 500 reach the cusp of bear market territory before major policy pivots triggered a sharp rebound throughout the remainder of the period.

The S&P 500 ended the quarter back at all-time highs after the wild ride depicted below. The index was up nearly 11% during the quarter after finishing the first quarter in negative territory. Softening trade rhetoric and resilient corporate earnings were key contributors to the index’s strong rebound. Growth stocks handily outperformed value counterparts as the artificial intelligence trade resumed its market leadership.

The equity rally was broad-based across US and international markets. US mid cap and small cap asset classes lagged US large cap but still posted solid returns of 6.7% and 4.9%. International developed and emerging markets moved in lockstep during the period and were the strongest performing asset classes again this quarter. A weakening US dollar continues to bolster international assets, which I discuss in more detail later in the piece.

Real estate and commodities were the only two negative-performing asset classes. We are tactically underweight both areas.

Bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, posted a muted return of 1.2% but continue to benefit from higher rates and rangebound (yet volatile) yields.

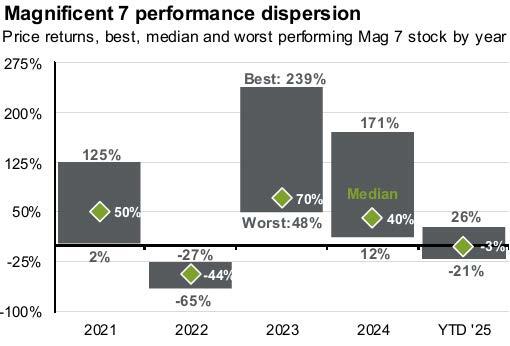

Performance of the popular Magnificent Seven basket of stocks has been atypically subdued so far this year. The median performer in the group has returned -3% over the first half and the basket is responsible for just 21% of S&P 500 returns in 2025, down from 55% in 2024 and 63% in 2023. It pays to be diversified in an environment such as this as a broader array of stocks contribute to returns.

Source: J.P. Morgan Asset Management, FactSet

Tariffs

President Trump’s “Liberation Day” executive order announced on April 2nd sent shockwaves through the global trading arena due to the severity and immediacy of the tariffs. The order established a 10% baseline tariff on virtually all nations and escalated to higher rates for countries with whom the US had higher trade deficits. Baseline tariffs were set to go into effect 72 hours after the announcement and larger tariffs seven days after. The order raised the US effective tariff rate from 5% to 25% - the highest rate in over 100 years.

Source: J.P. Morgan Global Economics, Michael Cembalest “Eye on the Market”, GS Global Investment Research

Markets reeled after the announcement. On April 3rd, the Nasdaq Composite Index saw its largest single-day point loss in history, and the S&P 500 shed $2.4 trillion in market capitalization. Japan's market triggered a circuit breaker on April 7th after opening down 8%. The severe market response prompted the Trump administration to pivot on April 9th, announcing a 90-day pause for negotiations.

The pause marked a market bottom as investors dashed back in. However, negotiations are still very much in process. Goldman Sachs projects that the average US effective tariff rate, which they estimate to be 9% currently, will climb to 14% by year-end. While markets rebounded post-pause, ongoing uncertainty surrounding US trade policy, the ultimate level of tariffs, and their potential inflationary impacts remain overhangs to continued market strength.

International Success

International and emerging markets have substantially outperformed US markets in the first half of the year, reversing a multiyear trend of US exceptionalism. The MSCI EAFE Developed Markets Index is up 19.9% year-to-date and MSCI Emerging Markets Index is up 15.6% versus 6.2% for S&P 500. International diversification has proved massively beneficial to portfolio performance this year.

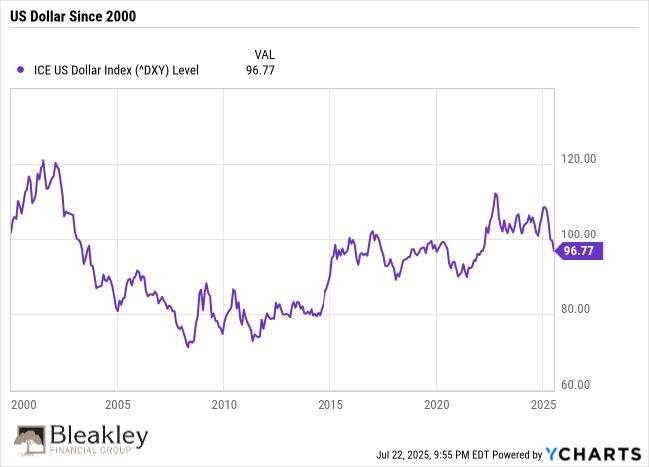

There are a few reasons for international’s hot streak. A weaker US dollar has been a tailwind for foreign stock performance. The dollar fell 6% during the quarter and 10.8% in the first half the year versus a basket of major currencies, marking the dollar’s worst first half since 1973. The rising US deficit and proposed tax cuts coupled with foreign pursuit of de-dollarization and a shift from dollar-denominated assets to gold and foreign-issued bonds have contributed to dollar weakness. Keep in mind that we firmly believe the US dollar will retain its reserve currency status. The dollar remains on solid footing near the base level of 100 in the ICE US Dollar Index as seen below.

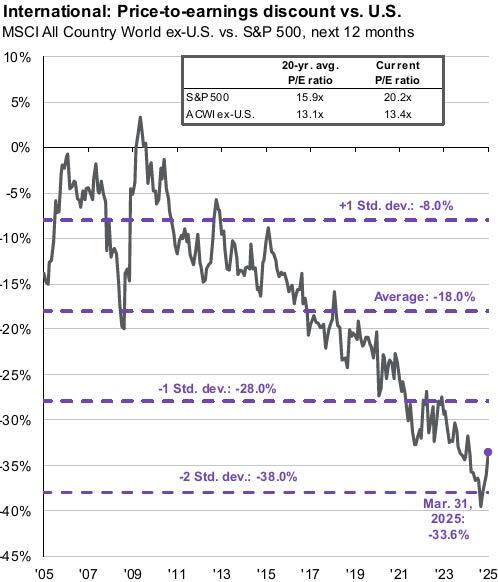

The valuation gap between US and international stocks was another factor in international’s outperformance. We have written about the valuation gap and stated that a reversion to the mean, however slight, would yield meaningful results for international equities. Coming into the year, international stocks were trading near historical lows versus US stocks. Even after international’s strong start, the asset class is still roughly 1.5 standard deviations cheaper than average, as seen on the chart below.

Bonds

The yield curve steepened during the quarter. Shorter-term yields declined on expectations of Federal Reserve rate cuts later this year and long-term yields climbed higher on concerns about the federal deficit and declining demand in US dollar-denominated debt.

Despite the volatility, core bonds inched higher during the quarter and spreads tightened as investors focused on strong corporate earnings and solid balance sheets. Our outlook on fixed income remains positive. Current yields are high, defaults are down, and we remain focused on quality issuances and strong management.

A note on the Fed – Chairman Powell and the Fed held rates steady once again in their June meeting and have not changed rates since the December 2024 cut. Powell has held firm in the face of mounting pressure and has reiterated that rate cuts will not occur until there are signs of economic weakness or durably lower inflation. The market is pricing in two cuts before the end of the year.

Outlook

Markets adeptly tuned out bouts of economic and political turbulence during the quarter on their march higher. The substantial rebound after the tariff-induced selloff serves as evidence of optimistic sentiment about future economic prospects both domestically and abroad.

Investors have been rewarded this year for staying the course and sticking with diversified portfolios and we see no reason why that approach will falter going forward. Market breadth and asset class divergence have set the stage for the continued success of diversification.

Markets are approaching an interesting juncture where global trade policy is changing at the same time the Fed is considering easing rates. We remain committed to helping our clients navigate this dynamic environment with discipline and sound decision-making.

Kyle Matthews, CFA on behalf of Miller Financial Services and OnePoint BFG Wealth Partners

OP# 25-0025

DISCLAIMER

Investment advisory and financial planning services offered through Bleakley Financial Group, LLC, an SEC registered investment adviser, doing business as OnePoint BFG Wealth Partners and Miller Financial Services.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Nothing in this material should be construed as investment advice offered by OnePoint BFG Wealth Partners or Miller Financial Services. This market update is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. Neither OnePoint BFG Wealth Partners nor Miller Financial Services guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward-looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.