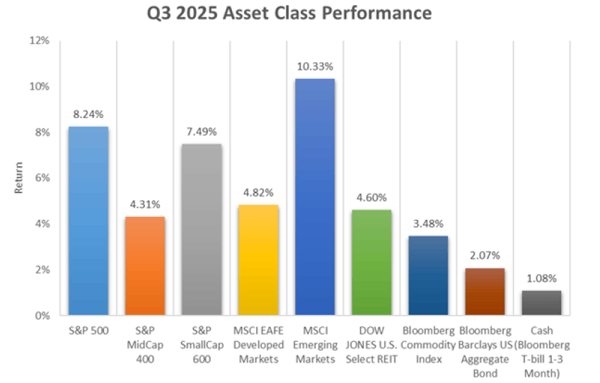

- Markets continued climbing throughout the third quarter. All nine asset classes charted below finished in the green and US growth equity and emerging markets posted double-digit returns. Bond performance benefitted from a rate cut that sent yields lower.

- The artificial intelligence (AI) trade remains in full effect. All top 10 contributors to S&P 500 returns this quarter were AI-related companies. Mega-cap tech resumed a period of stellar performance after stumbling earlier this year.

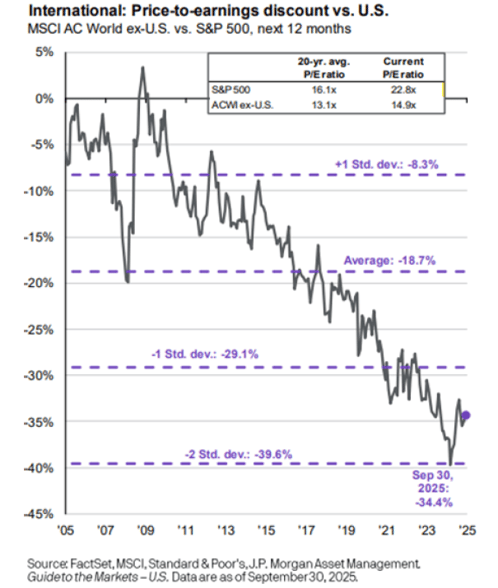

- Foreign equities maintained their stretch of strong performance. The attractiveness of cheaper relative valuations versus the US, green shoots of growth, and a still tepid US dollar supported the space.

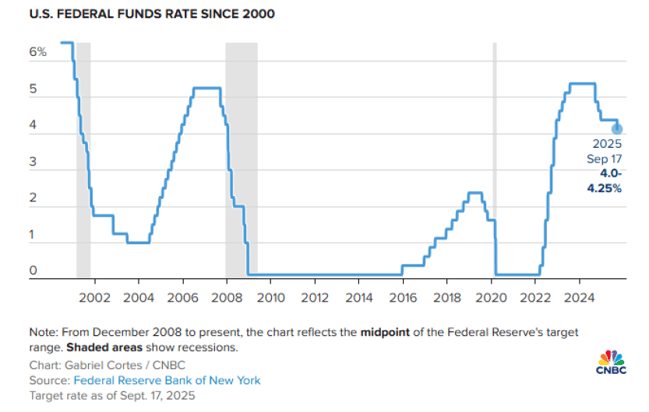

- The Federal Reserve (Fed) cut rates for the first time this year. Chair Powell shifted rhetoric from the typical inflation-first fight of the past few years to an emphasis on the slowing labor market.

Source: YCharts

Market Returns

All nine major asset classes enjoyed positive returns in the third quarter as the Federal Reserve cut rates for the first time this year, investors continued pouring into the AI boom, and corporate earnings remained solid.

The S&P 500 was up 8.2% during the quarter after posting double-digit returns in the prior quarter. The index is up nearly 30% since April lows post-tariff selloff and ended the quarter at a new record high.

The Russell 1000 Growth Index outperformed the Russell 1000 Value by over 7% due mainly to fervor surrounding the AI trade. The technology sector was responsible for half of the S&P 500’s gain this quarter and all of the top 10 contributors to performance were AI-related companies, as seen below. Alphabet, Microsoft, Tesla, and Palantir were key standouts. Alphabet’s 38% return was its strongest quarterly return in two decades.

US mid-cap and small-cap stocks also enjoyed solid returns of 4.3% and 7.5% respectively. Small-cap stocks tend to perform well in rate-cutting environments. They benefit from cheaper borrowing costs because they usually rely more on debt to fund growth and operations than large-cap companies.

Emerging markets (EM) was the top performing asset class this quarter and on a year-to-date period. EM has benefited from a weakening US dollar, continued easing in global trade tensions, and the AI trade. China was the main contributor to EM returns with the Hang Seng Tech Index rising 22.1%, supported by increasing AI spend and favorable policy developments for domestic chipmakers. Taiwan was another strong performer in EM with a 14.7% return.

Real estate and commodities continue to lag broader equities and we remain underweight both asset classes. Oil prices fell 0.8% while gold rallied.

Bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, finished the quarter up 2.1% as yields fell in tandem with the Fed’s rate cut.

Labor Market

The US labor market is still on solid footing but showing signs of cooling. Job growth is slowing and unemployment has ticked up slightly from 50-year lows to 4.3%. We are currently in a low hire, low fire environment where retiring workers and those leaving the US workforce are not being replaced. As such, the labor force participation rate fell in August to the lowest level since 2022. There is evidence that restrictive immigration policy is also playing a hand in falling participation rates.

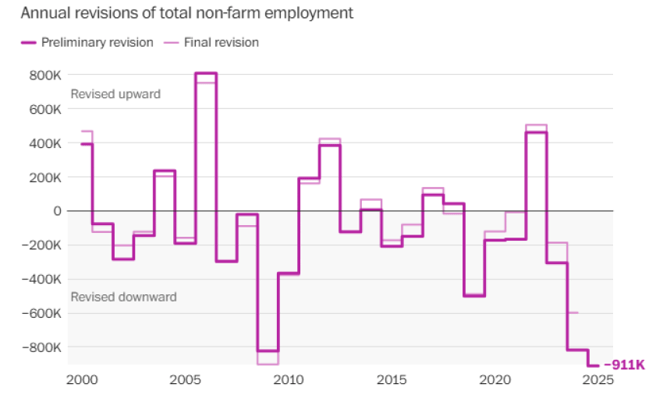

The Bureau of Labor Statistics (BLS) reported in September (before data grew harder to come by in the current government shutdown) a record downward revision of 911,000 fewer positions over the trailing one-year period ending March 2025, as shown in the chart below. The data will be finalized early 2026 and could improve, but the revision is stark evidence of sluggish job growth.

Source: The Washington Post, BLS

Wage growth remains solid at 3.9%, above the 50-year average of 3.8%, and the 4.3% unemployment rate is still well below the 50-year average of 6.1%. Falling labor force participation could prevent any meaningful rise in unemployment while also causing a pickup in wage growth.

Rate Cut

The Fed cut rates by a quarter point in September to 4.00 – 4.25%, marking an end to what was ultimately a nine-month rate pause. Fed Chair Jerome Powell said after the Federal Open Market Committee (FOMC) meeting in September that cooling in the labor market is outweighing concerns about inflation. That shift from one side of the Fed’s dual mandate to the other was the primary determinant for a rate cut, according to Powell.

Powell went on to say he is comfortable with the Fed’s current path and that he thought the central bank’s policy stance left them well positioned to respond to economic developments.

The market is pricing in two more rate cuts in 2025 and two in 2026 for a total of 100bps of cuts. We think the street has finally arrived at a reasonable level of expectations regarding cuts.

The International Trade

International developed equities are up 25.7% year-to-date and emerging market equities 28.2%, both handily outperforming the S&P 500’s 14.8%. Despite that performance delta, the valuation gap between international and domestic equities remains over one standard deviation away from average at 34.4% as charted below.

Foreign holdings have been a boon to client portfolios this year and we remain positive on the space due to said valuation gap, a weakening US dollar, and the diversifying nature of foreign allocations.

Outlook

Markets carried the optimistic tenor of the latter half of the second quarter into the third quarter and the broad-based rally marched on. At this juncture, market valuations are higher than normal as we enter an environment of possible slowing growth. In times like this, disciplined asset allocation and diversification are key. Portfolio diversification proved beneficial in the quarter and will remain a key focus of portfolios entering the fourth quarter to protect against any upcoming macro shocks.

In addition to rich valuations, trade uncertainty remains high. The 90-day US/China trade truce ends on November 10th. We are monitoring policy shifts and any effects on markets closely.

AI has been a major theme and has so far shouldered the justification for high equity valuations by way of value creation. Enthusiasm and investment in AI has contributed to strong corporate profits and we are now entering a mass-adoption phase of generative AI where labor productivity is set to soar by way of automation and continued scaling of technological applications. The piping is being put in place for AI to meaningfully boost corporate earnings but much remains uncertain. We are taking a measured approach to AI’s potential impact on markets.

Thank you for your time and trust. Please don’t hesitate to reach out to myself or your advisor with any questions.

Kyle Matthews, CFA on behalf of Miller Financial Services and OnePoint BFG Wealth Partners

OP# 25-0366

DISCLAIMER

Investment advisory and financial planning services offered through Bleakley Financial Group, LLC, an SEC registered investment adviser, doing business as OnePoint BFG Wealth Partners and Miller Financial Services.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Nothing in this material should be construed as investment advice offered by OnePoint BFG Wealth Partners or Miller Financial Services. This market update is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. Neither OnePoint BFG Wealth Partners nor Miller Financial Services guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward-looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.