Senator Max Baucus once noted that "tax complexity itself is a kind of tax." This observation rings particularly true heading into 2026, when substantial shifts in tax policy present both challenges and opportunities for financial planning. Changes affecting retirement savings, deduction limits, and other provisions make it critical for investors to understand how these modifications impact their financial strategies.

These developments are especially relevant for higher-income individuals approaching or past age 50. By examining these policy updates as integrated components of a comprehensive strategy rather than isolated changes, investors can position themselves to make more informed decisions throughout the year.

High earners face new retirement contribution rules

A notable modification for 2026 centers on catch-up contributions to retirement accounts. Employees 50 and older have traditionally been permitted to save beyond standard contribution limits, providing valuable flexibility for those building retirement funds. Beginning in 2026, individuals with Federal Insurance Contributions Act (FICA) wages of $150,000 or above must direct all catch-up contributions to Roth accounts, meaning these funds are contributed after taxes but grow and can be withdrawn tax-free later.

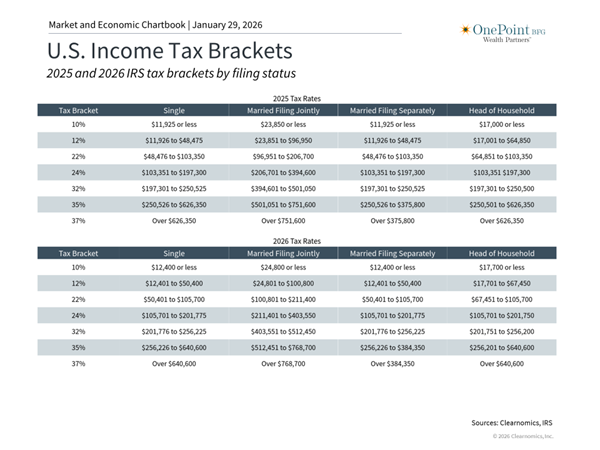

This adjustment eliminates the immediate tax reduction previously available through pre-tax catch-up contributions for high earners. Someone earning $150,000 who formerly reduced current taxable income through pre-tax contributions will now face higher tax liability in the contribution year, though they gain the benefit of tax-free withdrawals during retirement.

State and local tax deductions expand considerably

The state and local tax (SALT) deduction represents another significant change. Previously limited to $10,000 since 2017, this cap has increased to $40,400 for 2026 under the One Big Beautiful Bill Act (OBBBA), with annual 1% increases through 2029. This expansion particularly benefits residents of states with higher tax burdens.

The elevated cap makes itemizing deductions worthwhile for more households. When combined with other itemizable expenses like mortgage interest and charitable contributions, many taxpayers who have been using the standard deduction may find itemizing more advantageous. For example, a married couple with $35,000 in state taxes, $12,000 in mortgage interest, and $8,000 in charitable giving would see their itemized deductions total $55,000, exceeding the $32,200 standard deduction by a substantial margin.

Coordinating changes with broader financial goals

Understanding individual tax changes matters less than recognizing how they interact within your complete financial picture. For retirees, this includes considerations around Social Security taxation, which hasn't seen threshold updates in decades. Income increases from required Roth contributions could push more Social Security benefits into taxable territory.

Additionally, a new senior bonus deduction of $12,000 for married couples or $6,000 for individuals aged 65 and older applies from 2025 through 2028, though it phases out at higher income levels. The expanded SALT deduction creates opportunities for strategic planning, such as concentrating charitable giving or timing deductible expenses, though these benefits expire in 2030.

The bottom line? Tax changes for 2026 create a multifaceted environment requiring integrated planning. Taking a comprehensive approach to these updates can help strengthen long-term financial outcomes.

If you’re thinking about how current earnings trends fit into your broader financial picture, we’re happy to explore that perspective with you.

References

1. https://taxpolicycenter.org/briefing-book/what-are-itemized-deductions-and-who-claims-them

Investment advisory and financial planning services offered through Bleakley Financial Group, LLC, an SEC registered investment adviser, doing business as OnePoint BFG Wealth Partners (herein referred to as “OnePoint BFG”).

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The market and economic data is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The information in this report has been prepared from data believed to be reliable, but no representation is being made as to its accuracy and completeness.

This commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. No chart, graph, or other figure provided should be used to determine which securities to buy, sell or hold. No representation is made concerning the appropriateness of any particular investment, security, portfolio of securities, transaction or investment strategy. You should speak with your own financial professional before making any investment decisions.

Past performance is not indicative of future results. OnePoint BFG does not guarantee any specific outcome or profit. These disclosures cannot and do not list every conceivable factor that may affect the results of any investment or investment strategy. Risks will arise, and an investor must be willing and able to accept those risks, including the loss of principal.

Certain statements contained herein are statements of future expectations and other forward looking statements that are based on opinions and assumptions that involve known and unknown risks and uncertainties that would cause actual results, performance or events to differ materially from those expressed or implied in such statements.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

Advisors associated with OnePoint BFG may be: (1) registered representatives with, and securities offered through Purshe Kaplan Sterling Investments (“PKS”), Member FINRA/SIPC, (2) registered representatives with, and securities offered through PKS, Member FINRA/SIPC and investment advisor representatives of OnePoint BFG; or (3) solely investment advisor representatives of OnePoint BFG, and not affiliated with PKS. Investment advice offered through OnePoint BFG, a registered investment advisor and separate entity from PKS.

Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

OP 26-0112